The Rise of Cryptocurrency Exit Scams and DeFi Rug Pulls

Cryptocurrencies have been taking the world by storm in recent years, and the market has seen an explosion in the number of DeFi (decentralized finance) projects. However, with this growth comes an increased risk of exit scams and rug pulls. In this blog, we'll discuss what exit scams and rug pulls are, how they work, and what you can do to protect yourself.

What is an exit scam?

An exit scam occurs when the creators of a cryptocurrency project suddenly disappear, taking all the funds invested with them. These scams can be difficult to detect because they often involve a long period of building trust within the community. The scammers will typically invest a significant amount of time and resources into building their project's reputation, only to make off with the funds once they've gained enough trust.

What is a rug pull?

A rug pull is a type of exit scam that specifically targets DeFi projects. In a rug pull, the creators of a DeFi project will drain the liquidity pool, causing the value of the token to plummet. The creators then sell their tokens at the inflated price before the liquidity pool is drained, leaving investors with worthless tokens.

How to protect yourself from exit scams and rug pulls

One of the best ways to protect yourself from exit scams and rug pulls is to do your due diligence before investing in a cryptocurrency project. Here are some things you can do:

Research the team behind the project. Look for their names and background information online. Check if they have any history of fraud or scams.

Check the project's whitepaper. The whitepaper should contain detailed information about the project's goals, how it works, and how the team plans to achieve those goals.

Look for community feedback. Join forums and social media groups related to the project and read what other people are saying about it.

Check the project's code. If possible, review the project's code to ensure that it is legitimate.

Don't invest more than you can afford to lose. Cryptocurrency investments are risky, and there is always a chance that you could lose your investment.

Conclusion

Cryptocurrency exit scams and rug pulls are becoming increasingly common as the DeFi market continues to grow. It's essential to do your due diligence before investing in any project and to only invest what you can afford to lose. While it can be challenging to detect exit scams and rug pulls, taking these steps can help you protect yourself and your investments.

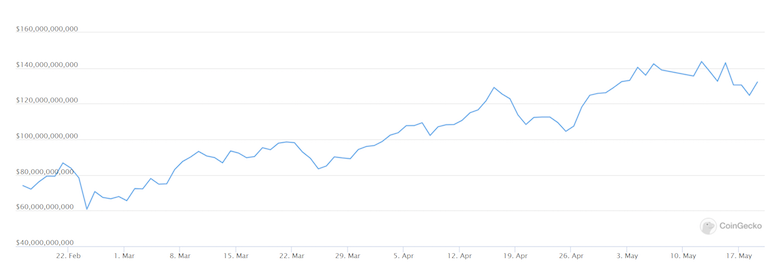

Rug Update